avalara tax codes canada

The rules for GST broadly follow the European Union and OECD VAT models. A reliable secure and scalable tax compliance platform.

P0000000 and U0000000 are generic codes that are used when you have items that arent mapped to an Avalara tax code.

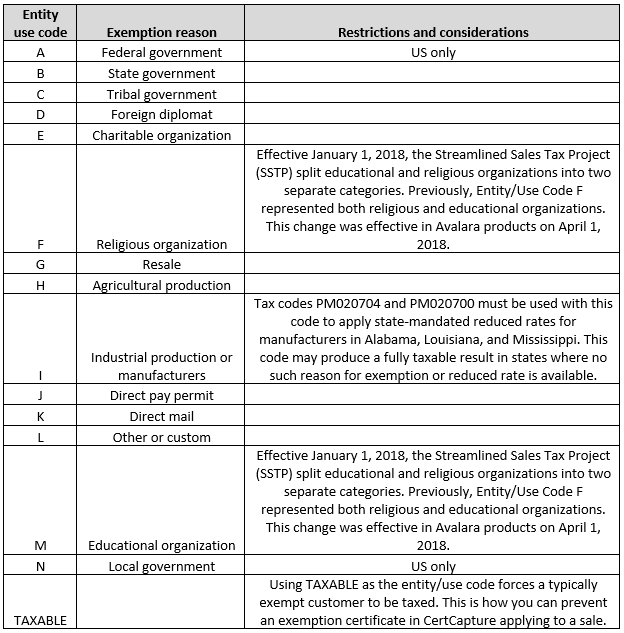

. The letters correspond to the exemption reasons from the Streamlined Sales Tax Certificate of. You can copy and paste from an Excel file or separate each. Find the Avalara Tax Codes also called a goods and services type for what you sell.

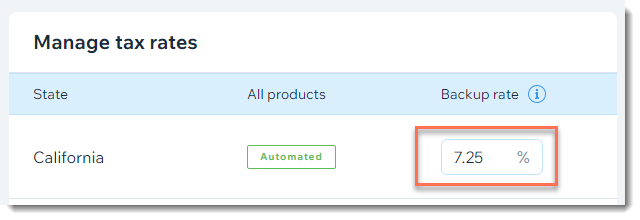

Select Where you collect tax. Set up tax rules to calculate GST for your tax codes. Canada operates a range of Goods Services Tax GST across the Federal and 13 Provinces.

Access a database of tax content rates and rules for 190 countries. Use one of the following tax codes to calculate rental taxes. The document letter email isnt recognized by state tax authorities.

The certificate lists an incorrect claim type or the certificate isnt accepted. So far in the developer guide your code has left the taxCode field emptyIn this case AvaTax assumes you are creating transactions that refer to general Tangible Personal Property which. AvaTax for Communications supports tax calculation for a number of countries states territories and provinces.

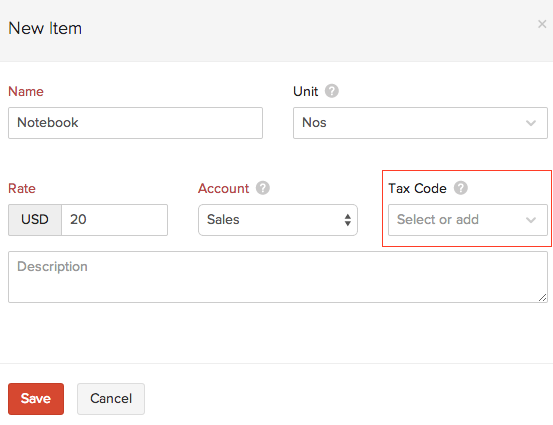

Leverage cloud-native software from a tax compliance leader. Click Settings at the top. You can either start typing and select from the list of available tax codes or paste the appropriate tax code.

Find the Avalara Tax Codes also called a goods and services type for what you sell. To ensure accurate tax calculation. Create a Product Taxability Tax Rule making the tax codes of the products non-taxable in Canada and in the province.

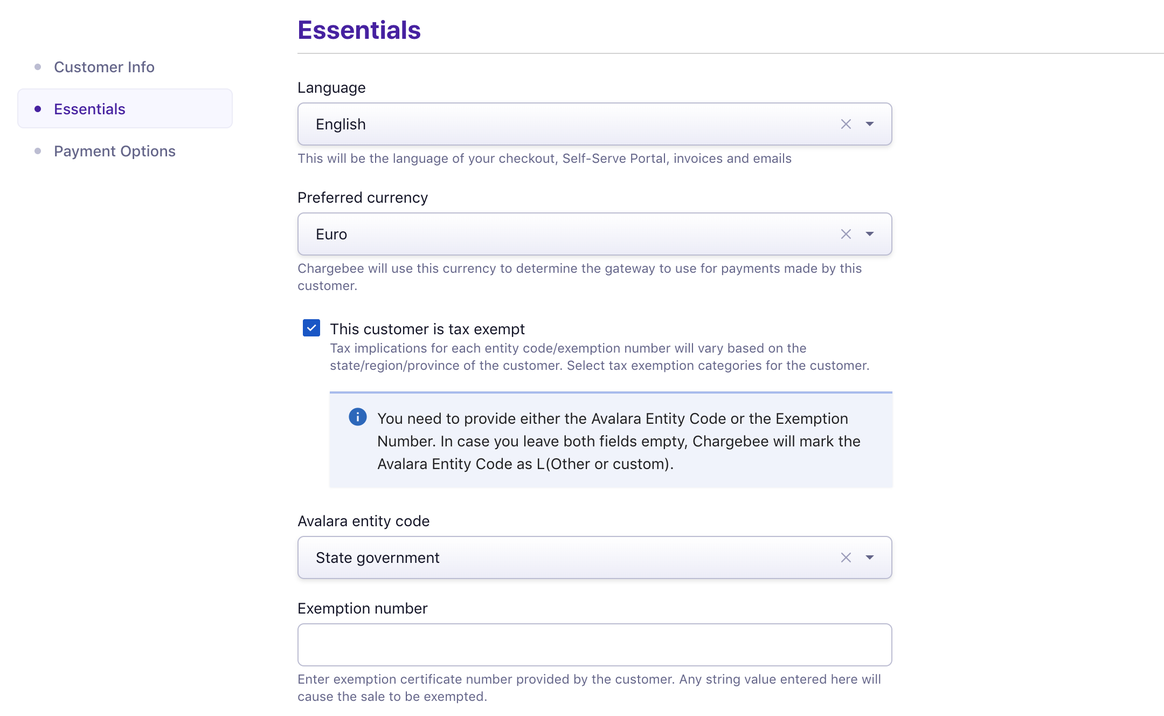

This is combined in most Provinces with the local PST which are set between 5 and 9 to create a Harmonised Sales Tax HST rate. Entity use codes are used to identify reasons for exemption available in AvaTax. These tax codes are.

Add up to 20 tax codes. 15 rows Canadian Federal GST is charged at 5. Its important to note that there is a maximum of 100000 items per import.

Freight transportation services that involve transportation of goods from a place outside Canada to a. Create a new password. You can copy and paste a code you find here into the Tax Codes field in the Items or What you sell.

P0000000 and U0000000. Rental or Lease of Tangible Personal Property -. If you must map more than 100000 SKU codes to.

In your Avalara account Click AvaTax Returns. Find the Avalara Tax Codes also called a goods and services type for what you sell. You can use this search page to find the Avalara codes that determine the taxability of the goods and.

Find the Avalara Tax Codes also called a goods and services type for what you sell. TaxCode the Avalara Product Tax code for the variant. There are a couple of different ways to learn which rate to use for what you sell.

The certificate includes a. Avalara Tax Changes 2022 Midyear Update Our latest update to your guide for nexus laws and industry compliance changes Avalara Commerce Monitor US. If youre already using Avalara tax.

Create an Exempt Entity Tax Rule making the entity use code of your. Click the link in the email you receive. You can use this search page to find the Avalara codes that determine the taxability of the goods and.

Wix Stores Setting Up Automatic Tax Calculation With Avalara Help Center Wix Com

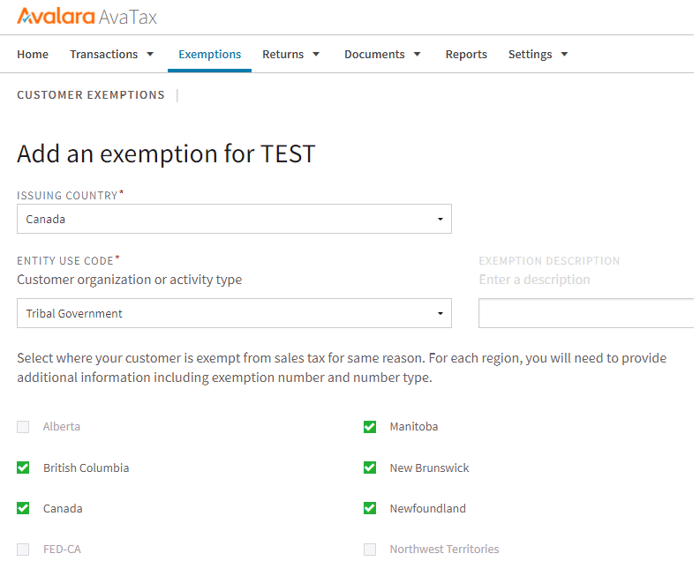

Avalara Avatax Set A Customer To Be Tax Exempt In U S And Canada

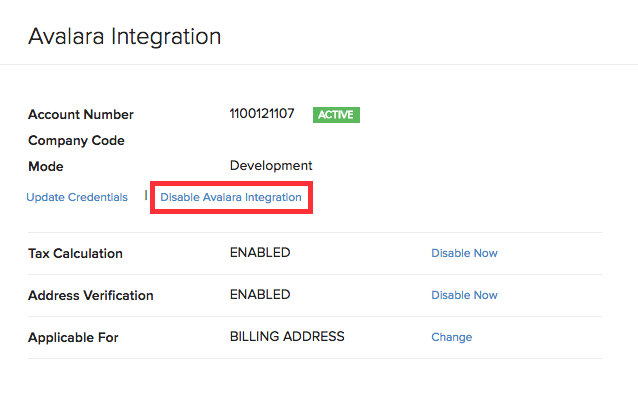

Avalara Avatax Integration Help Zoho Books

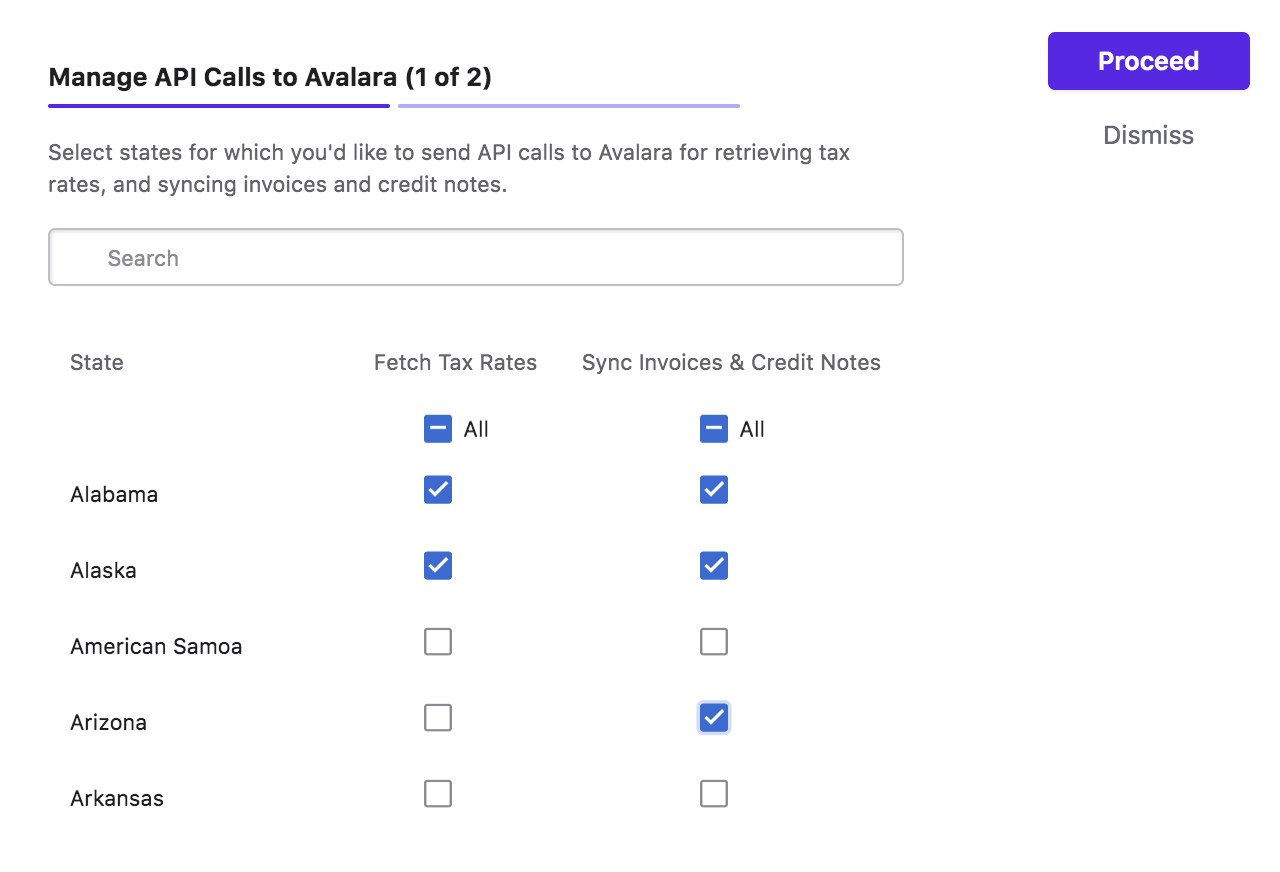

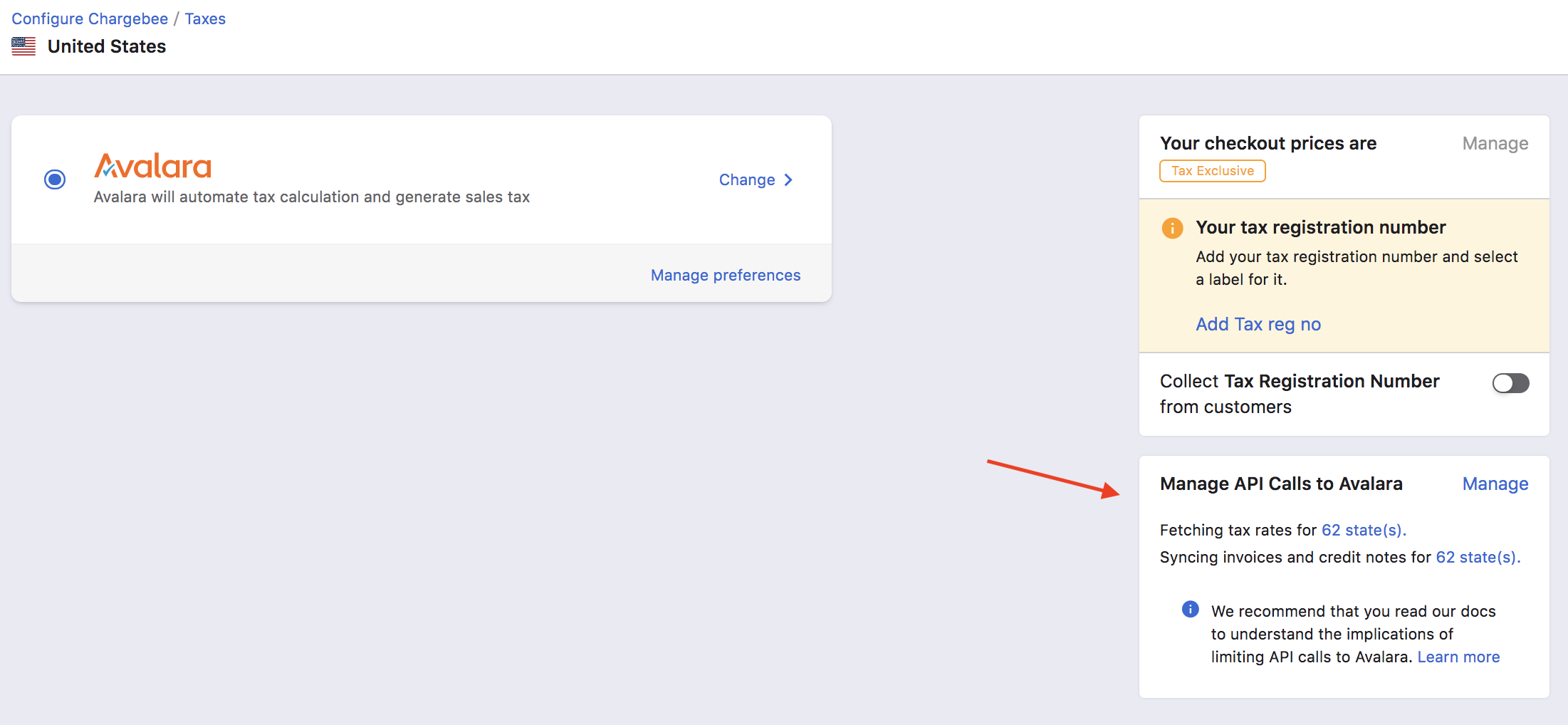

Avatax For Sales Chargebee Docs

![]()

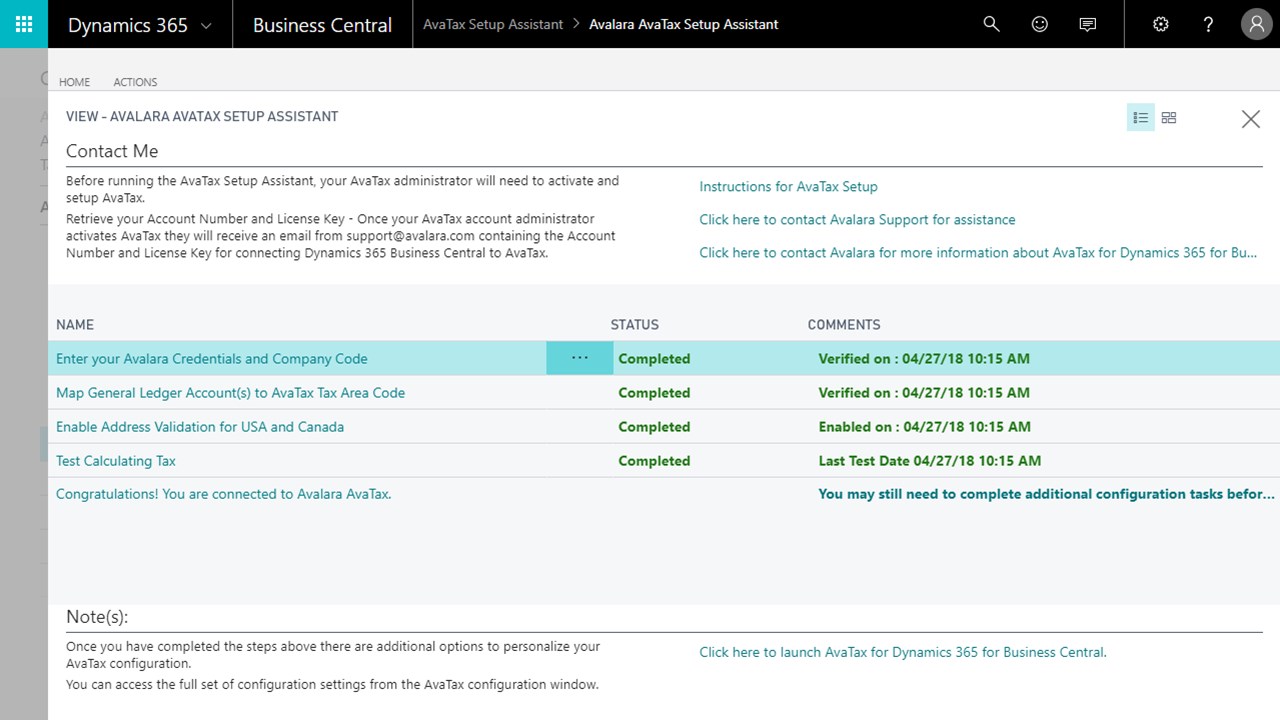

Odoo Avatax Module User Guide Ava Tax Calculation Service

Integration Barn2door Avalara Barn2door

Avalara Avatax Integration Help Doc Zoho Subscriptions

Avatax For Sales Chargebee Docs

Find The Right App Microsoft Appsource

Avatax For Sales Chargebee Docs

Avalara Avatax Set A Customer To Be Tax Exempt In U S And Canada

.jpg)